We’ve all faced a challenge that seems impossible to solve. Whether it’s a personal issue or a professional hurdle, our first instinct is often to approach it from a familiar angle. But what if the solution isn’t where you’re looking?

Life’s journey is rarely a straight line. It’s filled with forks in the road, unexpected opportunities, and the constant need to adapt. But how do you navigate this journey with purpose? The “Choice, Chance, Change” framework is a simple yet powerful exercise that empowers you to take control of your future.

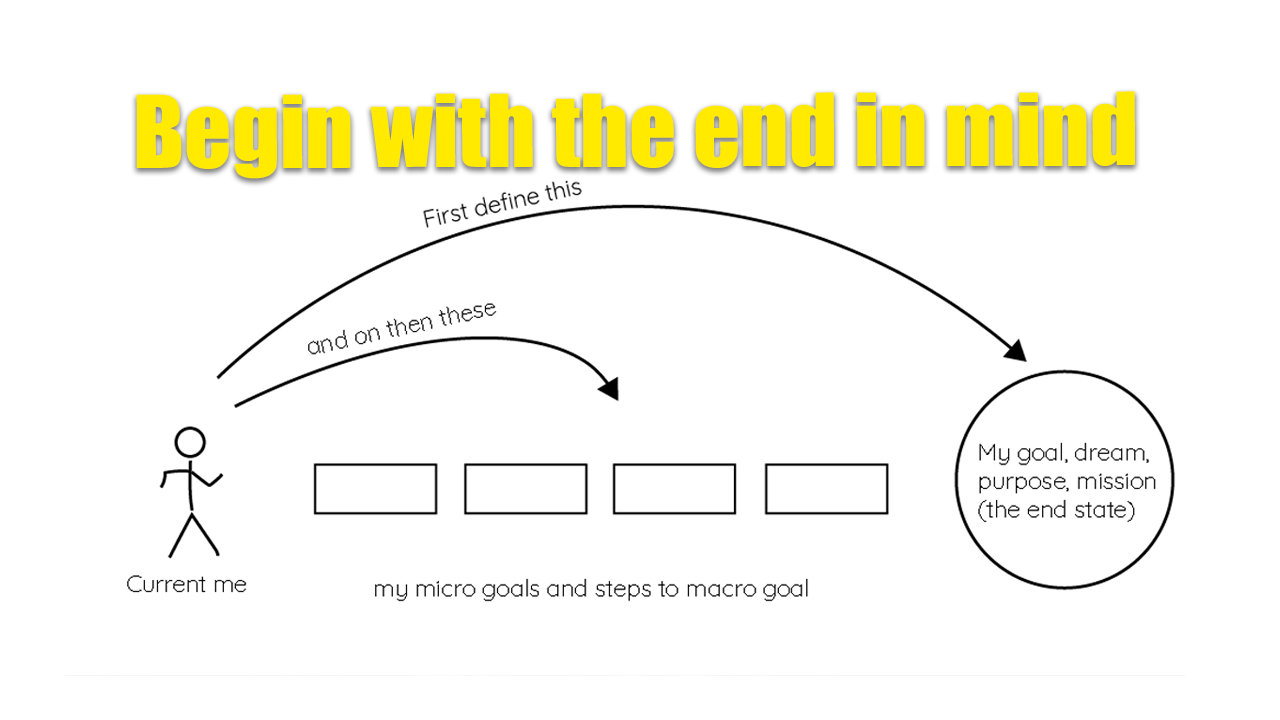

What if you could turn your dreams from a hazy future into a clear, actionable plan? The powerful principle of “Begin with the end in mind” is an exercise that allows you to do just that. It’s about harnessing the power of your imagination to envision your ultimate destination, and then working backward to create a roadmap to get there.

We all have them: those small, nagging thoughts that tell us we aren’t good enough, that something isn’t possible, or that we don’t deserve success. These are limiting beliefs, and they are one of the most significant barriers to personal progress and achieving our aspirations.

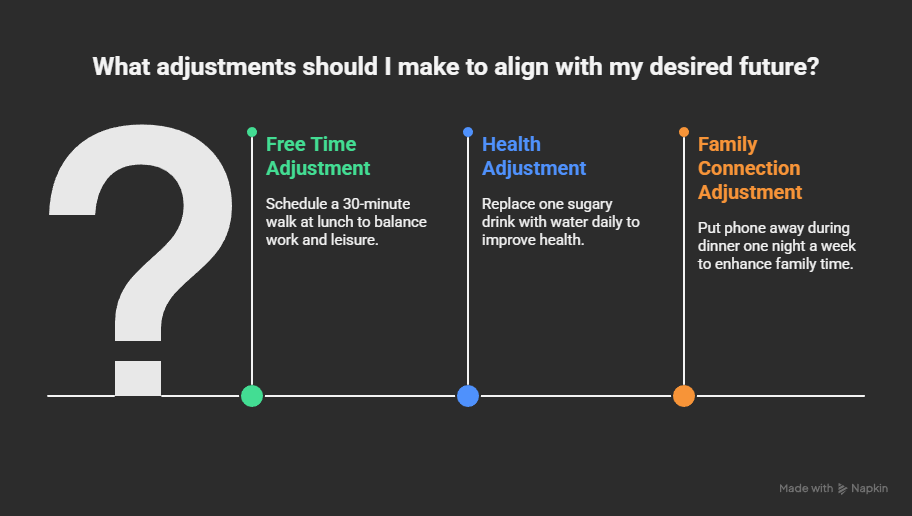

Have you ever had the feeling that you’re on a path, but it’s not quite the right one? You’re moving forward, but the destination doesn’t match the future you envision. This is where the transformative power of making adjustments comes in.

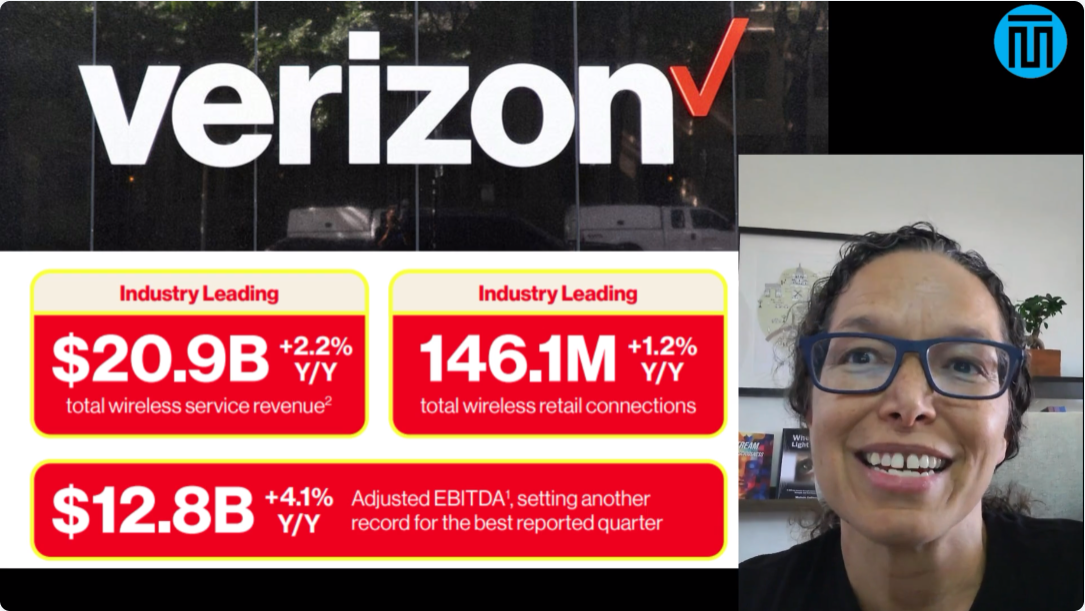

Hello, fellow Stock Market Landladies! Today, we're putting a spotlight on a familiar name in the telecommunications world: Verizon (VZ). As income-focused investors, understanding the fundamentals of a dividend stock is key to building a robust and reliable portfolio. Let's dig into some current data for VZ and see what it tells us.

Hello, fellow dividend enthusiasts and aspiring real estate moguls! Your Stock Market Landlady is back, and today, we're pouring over two titans of the beverage industry: PepsiCo (PEP) and Coca-Cola (KO). Both are often hailed as "dividend aristocrats" or "dividend kings" due to their consistent and increasing payouts, making them attractive options for those looking to build a reliable income stream. But which one fits best into your portfolio's "rental property" collection? Let's uncork some data!

Hey, and welcome back to the fireside chat by Mind Shift Theory! Today, we’re diving into a concept that’s been a game-changer for us: The Abundance Builders. If you’ve ever felt stuck, like you’re in a world of scarcity with limited options, then this is for you. Forget “just think positive”—we’re offering a new way to shift your perspective and open yourself up to a life of abundance.

So, what are these three powerful Abundance Builders? Let’s dive in.

Options Trading - Your Edge for the Week Ahead! 🚀 28-July-25.

Economic Calendar & Key News Events: Discover the major economic reports and news headlines that could move the markets and impact your trades.

Upcoming Earnings Season: Stay informed on which companies are reporting earnings and how these announcements might create volatility or trading setups.

Sector Rotation Analysis: Understand the current market trends and identify which sectors are gaining momentum or showing weakness. QQQ, SPY, and IWM

Trading Levels: We'll provide crucial support and resistance levels for the major ETFs – QQQ (Nasdaq 100), SPY (S&P 500), and IWM (Russell 2000) – to help you plan your entries and exits.

Possible Trades for the Upcoming Week: Get actionable insights and potential option trade ideas that we're watching for the next five trading days. Whether you're a seasoned options trader or just starting out, this weekly analysis is designed to give you a clearer picture of the market landscape and help you make more informed trading decisions.

Let’s be brutally honest. Whether you were blindsided by a pink slip or bravely walked away, the corporate world just dumped you. And it sucks. It’s not just a job loss; it’s an identity crisis of epic proportions.